| Investor Type | Firm |

| Industries | Software (Web Marketplace Saas..) • IT (& TMT) • Media • Businesses Solutions • Hardware (& Manufacturing) • Sales (& Marketing) • IoT (& Wearables) • A.I. (& Big Data) • Blockchain (& Cryptos) • Web Security (& Privacy) • Analytics • Cloud Services (& Infrastructure) • Human Resources • Logistics (& Distribution) • DeepTech • Investment Management • Woman Focused |

| Stages | Early,Acquisition, Seed, Series A, Series B, Pre-seed |

| Investing | United States |

| Investment Range | $100,000 - $5,000,000 |

| Investment Sweet Spot | $1,500,000 |

| Assets Under Management | $112,000,000 |

What is Glasswing Ventures?

Glasswing Ventures is a Boston-based venture capital firm established in 2016, with an emphasis on early-stage investments in technology companies.

They invest primarily in AI-powered technology, targeting sectors such as enterprise SaaS, IT software and data, marketing technologies, robotics, security, software space, artificial intelligence, social cognition, media, business solutions, hardware manufacturing, IoT, wearables, blockchain, web security, privacy, analytics, cloud services, infrastructure, human resources, logistics, distribution, deeptech, and investment management, including a specific focus on women-led startups.

With $112 million in assets under management, Glasswing Ventures offers a wealth of transactional experience from Founder and Managing Partner, Rudina Seseri, who has a formidable track record inclusive of transactions such as CrowdTwist's acquisition by Oracle.

They provide support to visionary founders leveraging the power of AI and frontier technology to reinvent enterprise and security markets. Glasswing Ventures positions itself not only as a financial investor but also as a strategic partner offering robust support in go-to-market, product, engineering, and finance strategies through their Building Partners model.

Their investment portfolio includes companies like Celtra, CHAOSSEARCH, inrupt, Plannuh, SocialFlow, Talla, Verusen, and Zylotech. Their financial commitments range typically from $100,000 to $5,000,000, with a sweet spot around $1,500,000, catering to early stages from pre-seed to Series B. Seseri's involvement with the Harvard Business School as a Rock Venture Capital Partner and other esteemed advisory boards underscores their commitment to nurturing the growth of the AI and technology ecosystem.

What they say:

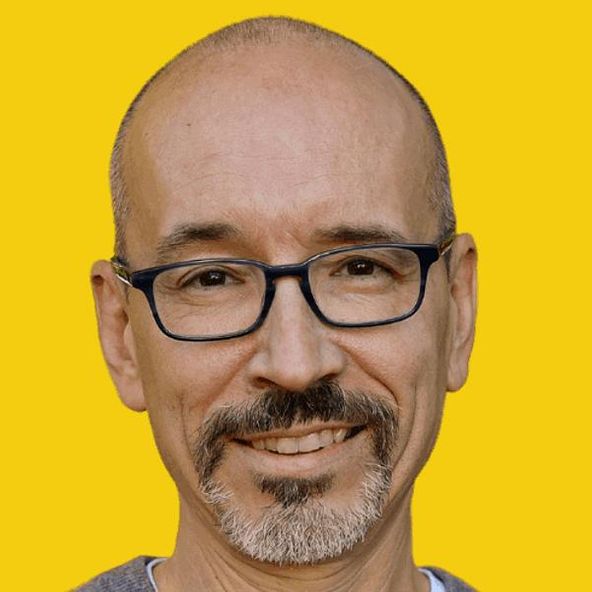

Rudina Seseri is Founder and Managing Partner of Glasswing Ventures, an early-stage venture capital firm dedicated to investing in the next generation of AI-powered technology companies. With over 17 years of investing and transactional experience, Rudina has led technology investments and acquisitions in startup companies in enterprise SaaS, IT software and data, marketing technologies and robotics. Rudina’s investments include Celtra, CHAOSSEARCH, CrowdTwist (Acquired by Oracle), inrupt, Plannuh, SocialFlow, Talla, Verusen, and Zylotech. Rudina is a Harvard Business School Rock Venture Capital Partner and Entrepreneur-In-Residence, serving for 5 consecutive years. She is also a Member of the Business Leadership Council of Wellesley College.Rudina serves as a member of the advisory board for GSK Consumer and the Philanthropy Board for Boston Children’s Hospital. She has been named a 2017 Boston Business Journal Power 50: Newsmaker, a 2014 Women to Watch honoree by Mass High Tech and a 2011 Boston Business Journal 40-under-40 honoree for her professional accomplishments and community involvement. She graduated magna cum laude from Wellesley College with a BA in Economics and International Relations and with an MBA from the Harvard Business School (HBS). She is a member of Phi Beta Kappa and Omicron Delta Epsilon honor societies.

Experience

Venture Capital | Technology | Board Director

Glasswing Ventures's investments on record

What are the investment firms similar to Glasswing Ventures

Underscore VC

Data Point Capital

Bunker Hill Capital

Riot Ventures

Venrock

Narrow Gauge Capital

Monitor Clipper Partners

Copley Equity Partners

.406 Ventures

- Prime Founders

- 85 Great Portland St.

- London, U.K.

- contact@angelspartners.com

Cambridge Massachusetts | U.S.A.

Cambridge Massachusetts | U.S.A.