Integrated Fundraising: The New Way to Raise Funds

November 27th, 2025

The Unspoken Tax on Founder Time

Every founder I’ve ever spoken to knows the feeling: you’re running a company, managing a team, delighting customers, and then you have to switch hats to become a full-time capital hunter. The biggest drag on this process isn't the pitch; it’s the administrative burden of managing hundreds of relationships, vetting potential investors, and, most painfully, navigating the murky waters of cold outreach.

The first piece of advice we all get is, "Fundraising is a relationship game." But if that’s true, why are so many tools on the market built purely for list management? Why do they treat investors like entries in a phone book rather than nodes in a living network?

This gap between advice ("build relationships") and available tools ("manage a spreadsheet") is precisely why we created Angels Partners as a unified system. We looked at the industry and saw fragmentation; a founder had to use one service for a contact list, another for email tracking, and a third for CRM, all while relying on a manual, tedious approach for the most valuable asset of all - the warm introduction.

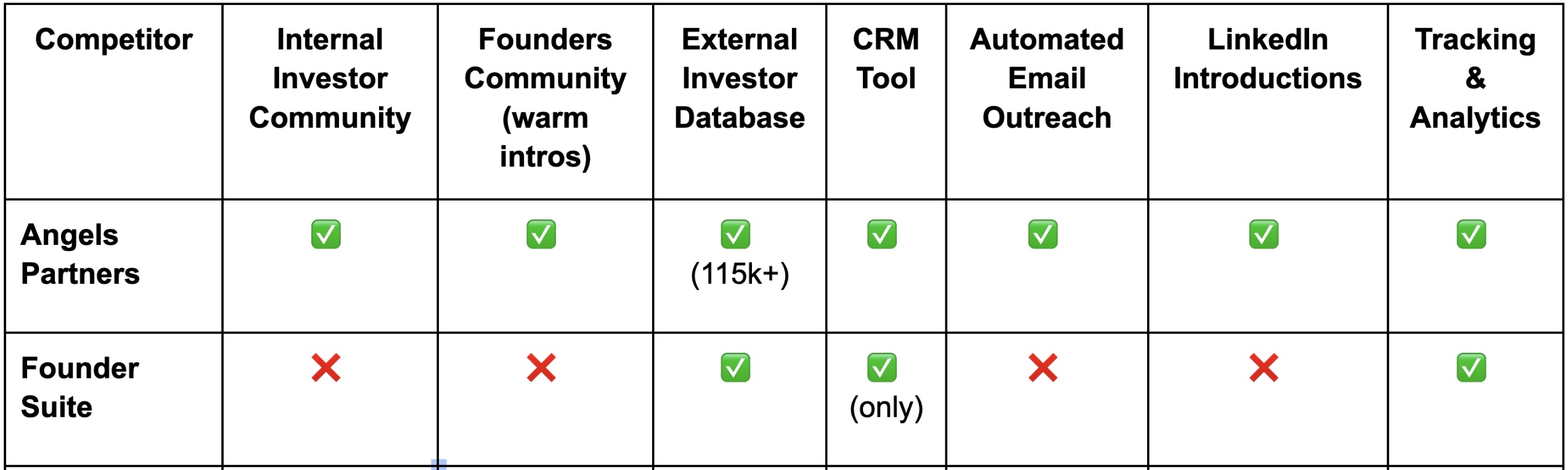

In this deep dive, we’re going to dissect the seven critical features that separate a truly integrated fundraising system such as AngelsPartners, from a list manager, like FounderSuite. We will show you why the ability to generate warmth, not just log cold contacts, is the single biggest factor determining fundraising speed and success to find angel investors.

1. Internal Investor Community: Why Trust Beats Traffic

When you approach a funding platform, you should be asking, “Is this a place where investors actively participate, or is it merely a database scraped from public records?” A key differentiator in modern fundraising is the existence of an Internal Investor Community.

- Angels Partners: We have built a vibrant, curated community of active and accessible angels and VCs, explicitly looking to connect with qualified founders. The "community" is not a separate feature; it’s the foundation of the platform's utility. This active presence means that the data is live, and the intent to engage is high.

- Founder Suite: This tool explicitly lacks an Internal Investor Community. This means that while you may find a contact's information, there is no verified context regarding their current activity level on the platform, or whether they are actively soliciting new deal flow through it. The burden of warming up that contact rests entirely on the founder’s shoulders.

The investor’s time is your most precious resource. A database contact is a potential lead, in fact, a member of an internal community is a verified, engaged buyer. When you use AngelsPartners, you are not sending a cold request into the void; you are submitting a pitch through a known and trusted pipeline. This immediate signal of credibility is how we drastically cut down the time spent waiting for initial replies. We facilitate connections within an ecosystem where trust is already being exchanged, rather than forcing you to build that trust from scratch every single time.

2. Founders Community: The Power of Peer Vetting

If an investor has $100 million to deploy, who are they most likely to listen to? Their lawyers, their friends, or their portfolio founders? The answer is unequivocally the portfolio founders.

But, you might be wondering, what is a portfolio founder and what is a portfolio founder referral? Well, a portfolio founder referral is a specialized warm introduction wherein a founder who has already received funding from a specific investor vouches for your company and character, serving as the strongest form of social proof and dramatically increasing your chances of securing a meeting.

Ultimately, the most potent form of a warm introduction is a referral from a founder who has successfully navigated a deal with that specific investor. It validates your business model, your team, and your founder potential, all in a single email.

- Angels Partners: Our platform is purpose-built with a Founders Community that facilitates this peer-to-peer exchange. You can identify which startups an investor has backed and connect with those founders within our ecosystem to ask for an introduction. This leverages the trust already established between the investor and their existing portfolio.

- Founder Suite: Lacking a Founders Community, this path of high-value social capital is completely inaccessible through the platform. A founder must go to LinkedIn, manually track down the portfolio company, and then cold-message that founder, introducing multiple points of friction and time-waste.

And before you say you’re too busy to network with other founders, you should know t's essential. Founder networking turns a linear, time-consuming process (pitching investor by investor) into a networked, compounding process. You aren't just networking with people who have money; you're networking with people who have leverage with the people who have money. By using the Angels Partners’ Founders Community, you find the quickest, most credible path to the decision-maker, transforming weeks of cold outreach into a handful of strategic, high-value conversations. If you want to accelerate your funding velocity, you must tap into the existing flow of trust and that flow runs strongly between founders.

3. External Investor Database: Utility vs. Volume

When we look at investor databases across both platforms, each offers a database, but the value is not in the list size alone; it’s in the utility of the data and its integration with the entire system.

- Angels Partners: We offer a substantial External Investor Database (115k+) to find angel investors, which provides the necessary volume. But our core value here is the filter fidelity: data is segmented not just by name, but by vertical, check size, typical round stage, and most importantly, is immediately cross-referenced with your mutual connections and our internal communities.

- Founder Suite: While they also provide an External Investor Database, without the integrating features like automated outreach or warm intro mapping, the list serves primarily as a static source of names. The founder must then export, manage, and enrich this data using outside tools, leading to data decay and inefficiency.

A list that stands alone is merely a phone book. A list that is integrated is a target acquisition system. The superiority comes down to how quickly you can move from identification to personalized action. If our 115k+ database allows you to filter down to 50 perfect targets, and then immediately enables you to track engagement with those 50 (see point 7) or map a warm intro (see point 6), it’s not just a bigger list, it’s a self-contained ecosystem for execution. The difference is spending a week manually verifying data versus spending an hour pitching.

4. CRM Tool: Integrated Assistant vs. Standalone Spreadsheet

A Customer Relationship Management (CRM) tool is the backbone of any fundraising effort. It ensures you never miss a follow-up or forget a crucial detail about an investor.

- Founder Suite: Their CRM Tool is listed as their primary focus. While good at data logging, a standalone CRM requires meticulous manual entry and often lacks the automation hooks necessary for modern, high-volume, personalized outreach. It excels at recording history but is weaker at driving the next action.

- Angels Partners: Our CRM Tool is designed as the centralized command center, integrated with all other features. Because it is connected to the Automated Email Outreach and Tracking features, the majority of engagement data (opens, clicks, deck views) is logged automatically. This minimizes the manual "homework" for the founder.

At the end of the day, integration matters because a fragmented workflow kills momentum. Think of a pilot flying an aircraft. They don't use three separate screens for navigation, fuel, and weather. They use an integrated dashboard. When your outreach system (Automated Email Outreach) speaks directly to your tracking system (Tracking & Analytics), and feeds that data back to your CRM Tool, your workflow becomes frictionless.

5. Automated Email Outreach: Scaling the Conversation, Not the Spam

This feature is where the rubber meets the road. Once you’ve built your perfect target list, you need to contact them efficiently without resorting to mass, generic emails.

- Angels Partners: We provide Automated Email Outreach functionality. This allows you to segment your 115k+ database and send highly personalized, tracked email sequences to hundreds of investors, all while monitoring opens and clicks. This scales your communication while ensuring the messages are targeted and professional.

- Founder Suite: This tool explicitly lacks Automated Email Outreach. This forces founders to export their list and use external, often expensive, third-party email automation software. This fragmentation introduces data security risks, inconsistent branding, and complex tracking issues, leading back to the manual workflow we aim to eliminate.

Our automation is designed to save you the time of individually clicking "send" and logging the action. It does not write the content. Because the feature is integrated with the database, you can use our templates to insert personalized fields (e.g., "[Investor Name], I noticed your fund recently invested in [Portfolio Company]"). This ensures the message is contextual and relevant. The automation only serves to make a highly personalized process scalable and trackable, preventing you from wasting days manually managing hundreds of email threads.

6. LinkedIn Introductions: The Digital Handshake Mapping

The concept of a "warm intro" is critical, and this feature is the engine that drives it. It is the sophisticated step that turns connections into conversions.

- Angels Partners: The LinkedIn Introductions feature uses data mapping to visually demonstrate the most viable connection path between you and a target investor. This goes beyond a simple search; it actively highlights the strongest potential links, often revealing mutual connections you may have forgotten about or didn't realize were strong enough to approach.

- Founder Suite: This feature is explicitly missing. This lack means that every connection search must be executed manually across multiple platforms, a slow, unreliable, and often frustrating process that leads to missed opportunities.

So, how can you use the LinkedIn Introductions feature to find angel investors?

This is the core of our platform's value. Once you filter your target investor:

- Click the LinkedIn Introductions mapping feature.

- The system displays mutual connections, prioritizing those with the highest network overlap.

- You identify the strongest connection—let's call her Sarah—who knows the investor.

- You then reach out to Sarah with a specific, non-generic request: "Hi Sarah, I see you're connected to Jane Smith at XYZ Ventures. I'm raising a Seed round for a company in a vertical Jane has recently backed. Would you feel comfortable making a one-line introduction?"

This approach is high-leverage and respectful of everyone's time, making it the fastest way to get your foot in the door. We provide the digital map; you just need to walk the short, guided path.

7. Tracking & Analytics: Predictive Power vs. Historical Record

Both platforms offer analytics, but there is a world of difference between historical record-keeping and predictive, actionable intelligence.

- Angels Partners: Our Tracking & Analytics are comprehensive and integrated. We don't just log when an email was opened; we show you engagement patterns. This data is the early warning system for your round. You can detect future pressure points, such as high engagement but no reply (signaling pitch confusion), or low open rates for a specific segment (signaling a poor subject line).

- Founder Suite: While they track data, without the integrated outreach and community features, their analytics are limited to what you manually log, and often focus only on the historical record: "I sent an email on this day."

If an investor views your deck three times in a single day, it means they are doing due diligence, sharing it internally, or comparing you to a competitor. That insight is far more valuable than simply logging a reply. It is the signal that tells you, "Focus here, this is warm." By focusing on these predictive metrics, you can strategically allocate your limited time to the most interested parties, boosting your close rate.

Final Thoughts: The Choice Between Integrated System and Fragmented Tools

As founders, we need to be efficient, strategic, and data-driven. The old way, using separate tools for networking, email, and logging, is expensive, slow, and leaves too much to chance.

We built Angels Partners to provide the missing layer: network generation and automated warm intros, integrated seamlessly with best-in-class CRM and tracking.

The comparison is clear: Angels Partners is an integrated fundraising command center; competitors that lack an Internal Community, Warm Intro mapping, and Automated Outreach are simply fragmented list managers.

If you are serious about accelerating your fundraise, you cannot afford to leave your most critical task, building relationships, to manual chance. We give you the data, the community, and the tools to make your next conversation a warm one.

Want to dive into more founder strategies for accelerating your close? Check out our other guides on the Angels Partners’ blog, where we share battle-tested insights from the front lines of venture capital.

Stop wasting time on cold emails. Join Angels Partners today and command your fundraising process.

This is where Angels Partner steps in, helping investors in their search for ambitious and promising startups.

Our selection process is rigorous and the matchmaking is affinity based to ensure optimal results.

TRY IT OUT